Doing user research to inform strategy

The application of user research to develop products and services is well-established. To create a product or service that’s successful, we have to understand how customers are using it so we can improve it. We know this drives business outcomes, as well as customer satisfaction. And yet we rarely apply this thinking to our wider organisational strategy.

When it comes to the question of developing an organisational strategy, many organisations still believe in the ‘ivory tower’ method: They bring leaders together in a room until they are aligned on a direction for the organisation. It is strategies like this which often see organisations fall into the trap of chasing goals that fail to consider how they will create value for their customers.

The alternative is to base your strategy and investment decisions on the unmet needs of existing and potential customers, gathered through user research. Adopting this approach takes guts and humility, admitting that you don't have all the answers and that understanding customer needs is essential for creating value.

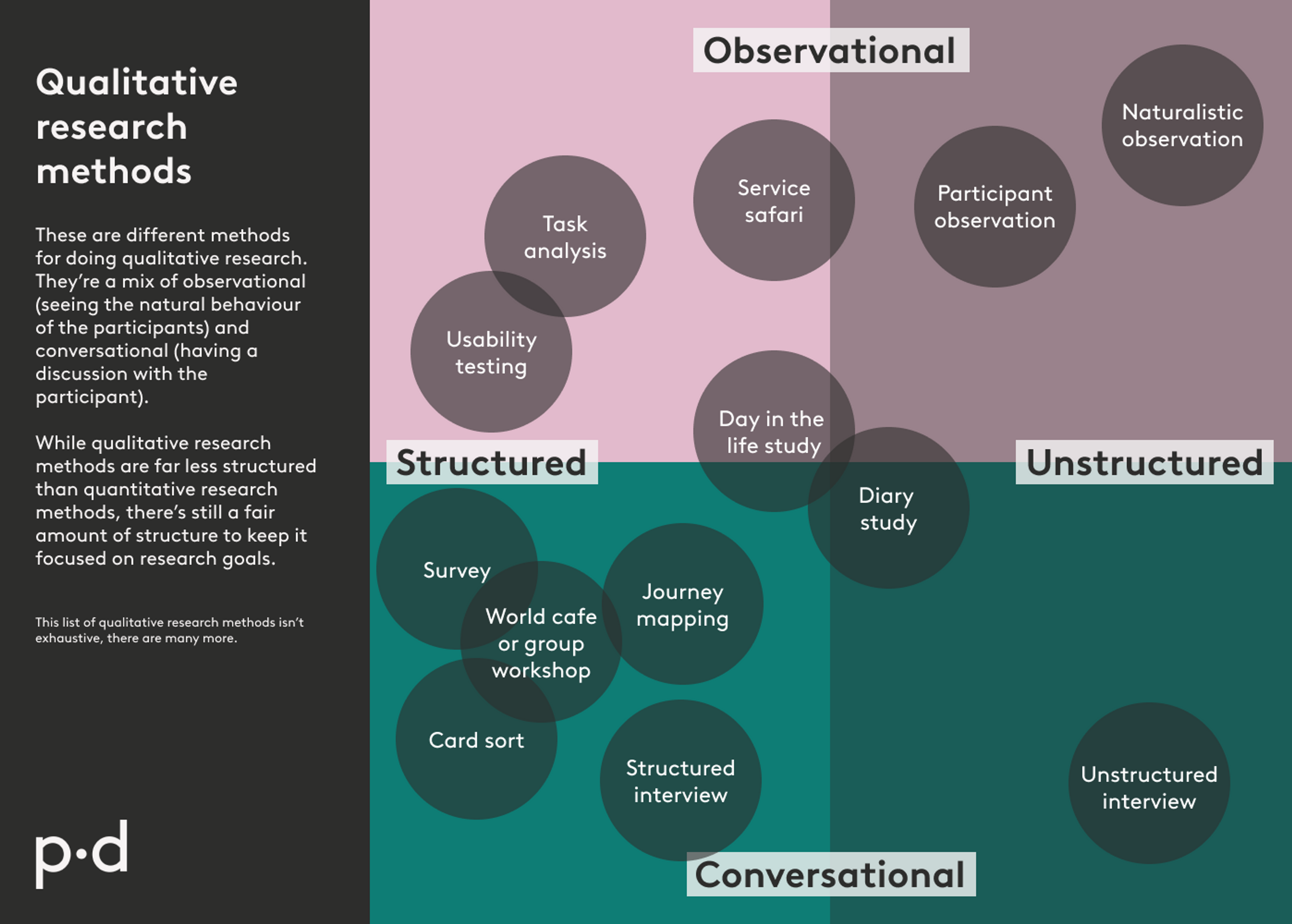

One of the most effective ways to gain a deep understanding of your customer’s needs and motivations is through qualitative user research. This is research conducted with existing and potential customers using observational and conversational methods.

But, as with all good user research, this methodology isn’t just a case of asking customers what they want. It's about understanding your research goals, choosing appropriate methods, analysing the data, and communicating findings to support strategic development.

Here are some ways to do that:

Using research methods to inform strategy

Aim for open, generative methods that increase your understanding of who your customers are as people, beyond users of your existing products and services. Spend quality time with users, through observation or unstructured interviews, to understand their behaviours and needs beyond their interactions with your organisation's services.'

For example if your primary product is a reporting tool for financial teams, observing how the teams work together will help identify the other software and tools they end up using in addition to yours.

Consider broadening your participant pool. While speaking to existing or similar users is valuable, don't overlook the insights that expert users, lead users, or even your competitors' customers can offer. These people have often developed existing workarounds and hacks or have even built their own solutions to problems that could inspire your future direction.

If you already have user research happening in your organisation, find the people doing it, and ask them to share what they already know. While the research they’ve been running might be product-focused, any good researcher will also be picking up stories about the gaps in your current service offering. Combining this with input from frontline staff in customer service and other internal data on service usage would be a good place to start building a user-centred strategy.

Do analysis collaboratively and in the open. The process of transitioning from identifying usability issues to finding wider behavioural insights takes a shift in mindset. By involving key stakeholders early on, you ensure alignment and commitment to the direction your research suggests.

Strategic research needs to have an opinion

The value of any user research is dependent on how well it is communicated to the teams taking action on it. In this case, to those who are accountable for setting strategy, and indirectly the rest of the organisation. One of the powers of doing research directly with users is that you can use their voice to speak to leadership, encouraging empathy and giving them sight of the reality of the user experience.

It’s important that research findings aren’t passive. Strategic research needs to have an opinion. What do these findings mean for your organisation? What do they mean for what you’re going to do next?

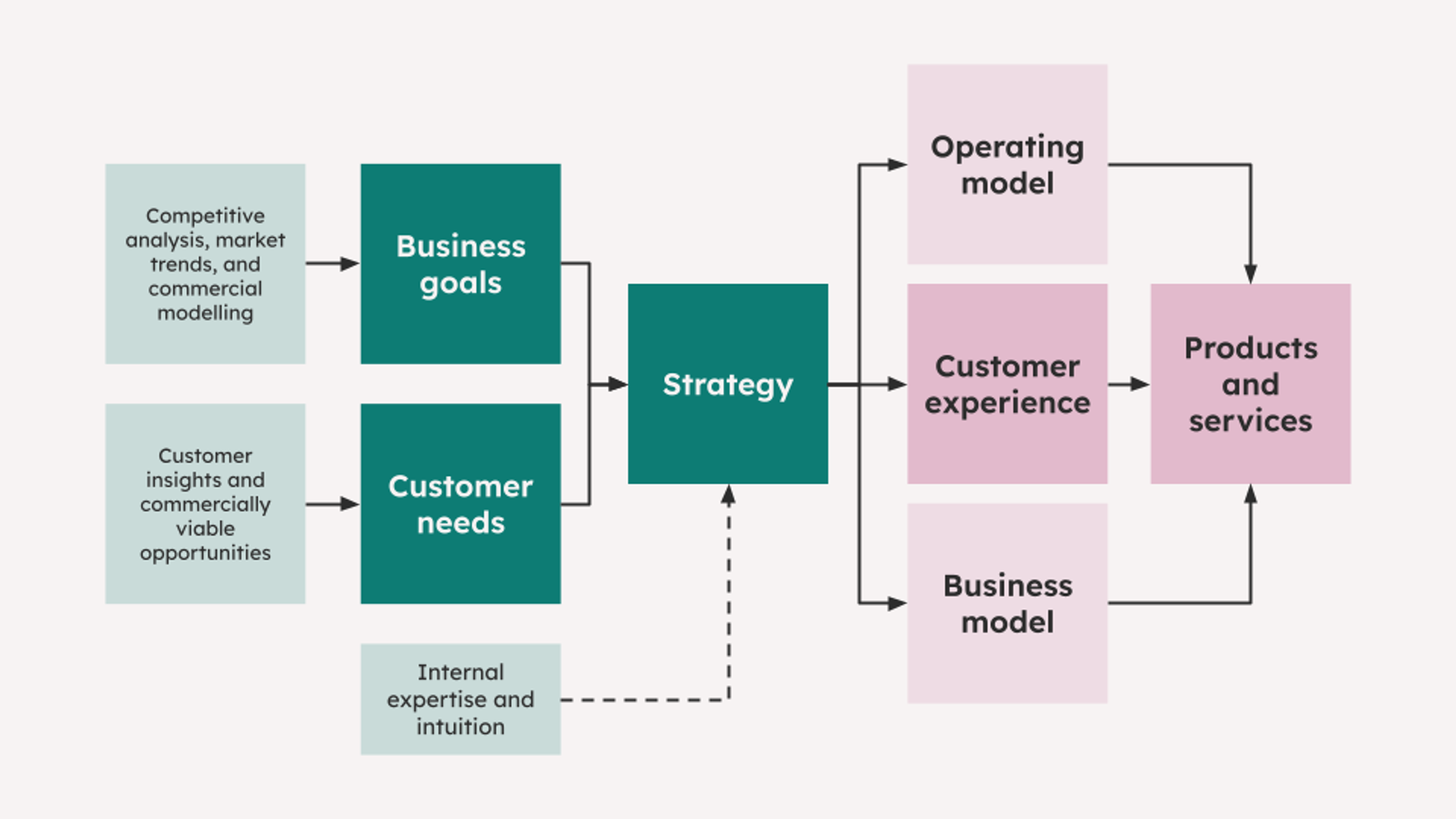

Good strategic research will help you achieve clarity on what your customers need, and therefore what your organisation should offer your customers. It will help you to evolve your customer experience, your business model, the products and services you provide, and how your teams are set up to deliver.

There’s no certainty in any of this. Which is why it’s fundamental to balance the findings of your strategic research with the expertise of people in your organisation, market trends, and competitive analysis when deciding where to place your bets. The better informed your bets are, the more confident you can be in placing them. While research can’t provide certainty, its value lies in enabling organisations to look for clues about their customers and their unmet needs. In this way, user research is about understanding people, which is the key to success in any industry.

Once those clues have been unearthed, they will point you towards customer needs that your organisation alone is well positioned to meet.

Written by

Katherine Wastell

Senior Director

Alistair Ruff

Director